Taiwan's banks are typically small and used to focus on the domestic market. The overall competitiveness of the industry is inadequate, which further limits the potential for banks to expand abroad. If these problems are to be resolved, consolidation and transformation in Taiwan's banking sector is unavoidable. Mergers within the private and public sectors in Taiwan are the most likely way to achieve this, with cross-sector mergers only likely to come later.

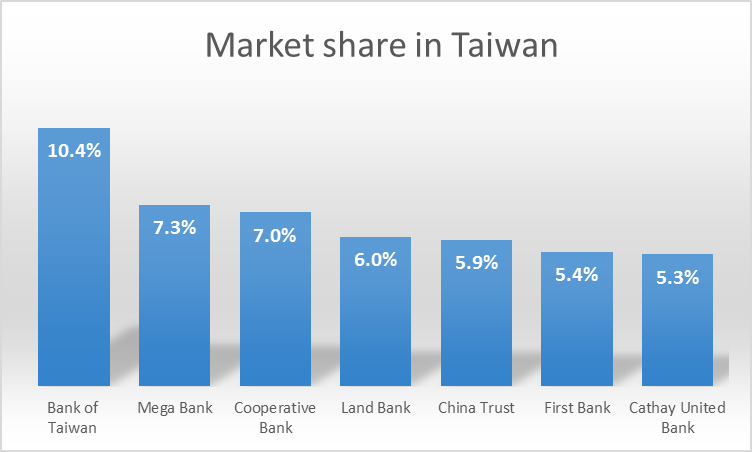

The domestic financial services market is fragmented, with predominantly small players, making it impossible for the banks to compete in the global marketplace. For instance, the Bank of Taiwan is the nation's largest domestic bank, but only ranks No. 163 globally. The country's three largest banks, including Bank of Taiwan, Mega Bank, and Cooperative Bank, only have a domestic market share of 24.7%, far below Singapore's 94.2% and Hong Kong's 60%, and even lower than the U.S.'s 42.3%. In general, Taiwan's domestic market concentration in the banking sector is too low.

Market share in Taiwan, Source: Financial Supervisory Commission (FSC)(2015)

In the coming years, the business model and territory of Taiwan's banking industry will drastically transform due to five digital trends: (1) development of the Internet of Things, (2) thriving social media networking sites, (3) popularizing mobile internet, (4) applying data analytic technology, and (5) the prevalence of cloud storage. For instance, the FSC launched the Digital Financial Environment 3.0 initiative to upgrade "internet networks" and "mobile communications" in 2014. Its aim was to promote financial innovation of the banking industry, and to create advantageous conditions for the development of a digitized financial environment.

The FSC has begun promoting a digital financial environment in three dimensions to encourage the innovation of internet financial services, to disseminate mobile payments and third party payment applications, and to strengthen financial big data analysis. Through the deregulation of laws for the banking, insurance, and security industries, the FSC has encouraged these industries to explore online business practices and create new online financial services, in a bid to catch up with brand new consumption patterns and behaviors over the next few years.

Regarding Taiwan's insurance industry, the insurers now can offer part of their services online by providing clients with the option to purchase insurance and the option to adjust the desired amount online. Subsequently, this will broaden the variety of insurance purchases and balloon the amounts that are insured online.

The FSC has lunched the regulations to allow the banking, securities, and insurance industries to have 100% investment in core financial businesses related to Big Data companies, mobile payment businesses, or biometric authentication businesses and other FinTech businesses in the financial technology industry.