Taiwan's semiconductor industry has uniquely well-developed upstream and downstream vertical integration, and the entire IC industry value chain has a finely differentiated division of labor. The upstream portion of the industry consists of chemicals and silicon wafers; the mid-stream portion consists of the IC design industry, IC manufacturers, and IC packaging and testing firms; and the downstream portion consists chiefly of systems firms producing end-user PCs/NBs, cell phones, and consumer electronics.

Taiwan possesses an all-encompassing semiconductor industry ecosystem, with upstream, midstream, and downstream segments that are developing in parallel. The advantages of cost efficiency, flexibility, and speed resulting from the vertically integrated infrastructure and the industry cluster effect have made Taiwan's IC industry highly competitive in the global market. Not only is Taiwan's IC design industry the world's second-largest, but the domestic wafer fab and IC packaging/testing segments are both world leaders in their categories.

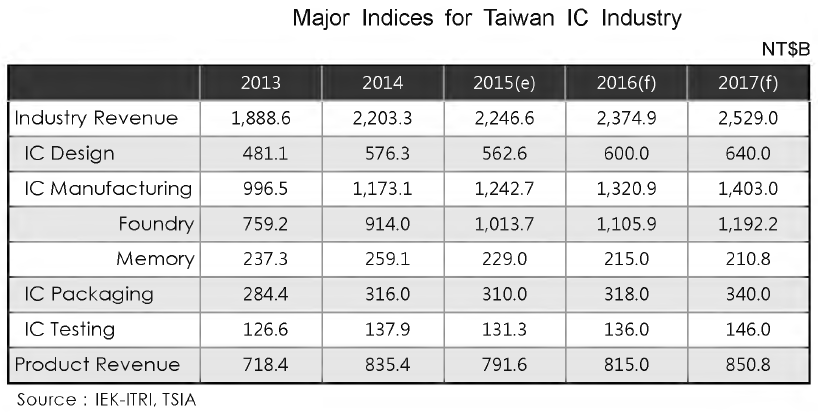

Taiwan's semiconductor revenue (including design, manufacturing, packaging, and testing) totaled NT$2.2 trillion (about US$72.5 billion) in 2014, up 16.7% from 2013, with NT$576 billion (US$19.0 billion) in design, a 19.8% increase; NT$1.17 trillion (US$38.6 billion) in manufacturing, a 17.7% increase; NT$914.0 billion (US$30.1 billion) in foundry, up 20.4%; and NT$259.1 billion (US$8.5 billion) in memory, up 9.2%, NT$316.0 billion (US$10.4 billion) in packaging, up 11.1%; and NT$137.9 billion (US$4.5 billion) in testing, up 8.9%. Representing 30.4% of the US$335.8 billion worldwide market, Taiwan's IC industry was ranked number two in the world, second only to the US market.

By the end of 2014, Taiwan's semiconductor industry consisted of 245 IC fabless design companies, 16 fabrication companies, 37 packaging and testing companies, 7 substrate suppliers, 11 wafer suppliers, and 3 mask makers.

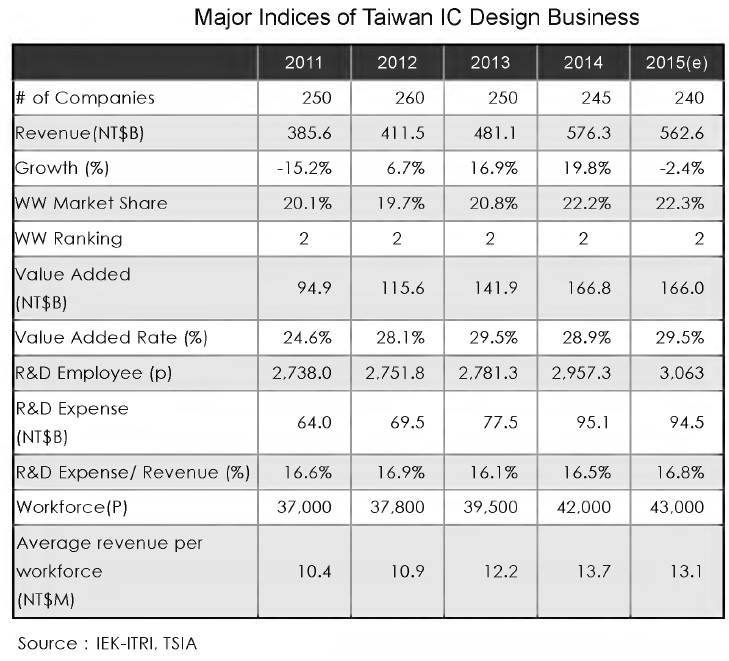

Benefiting from the growing demand for smart mobile devices in China and some companies' adoption of the 20nm technology, Taiwan's IC design industry grew 19.8% year-on-year in 2014, with revenue reaching NT$576.3 billion, which accounted for 22.2% of the worldwide IC design market and ranked number 2 worldwide, following the US.

IC Design

In 2014, there were 245 IC design companies in Taiwan. The major companies are Mediatek, Novatek, PHISON, Realtek, and Himax.

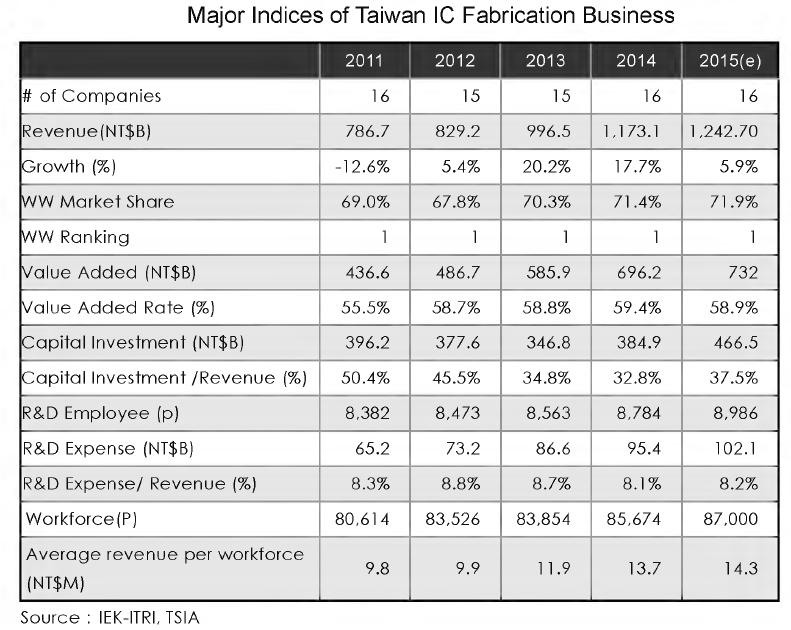

IC Manufacturing

Taiwan's IC manufacturing revenue hit a record high in 2014 of NT$1.17 trillion, up 17.7% from 2013, thanks to revenue growth from new mobile communication devices and demand for special process technologies for IoT products.

In 2014, there were 16 IC wafer fabrication companies in Taiwan, including foundry companies such as TSMC, UMC, and Nanya.

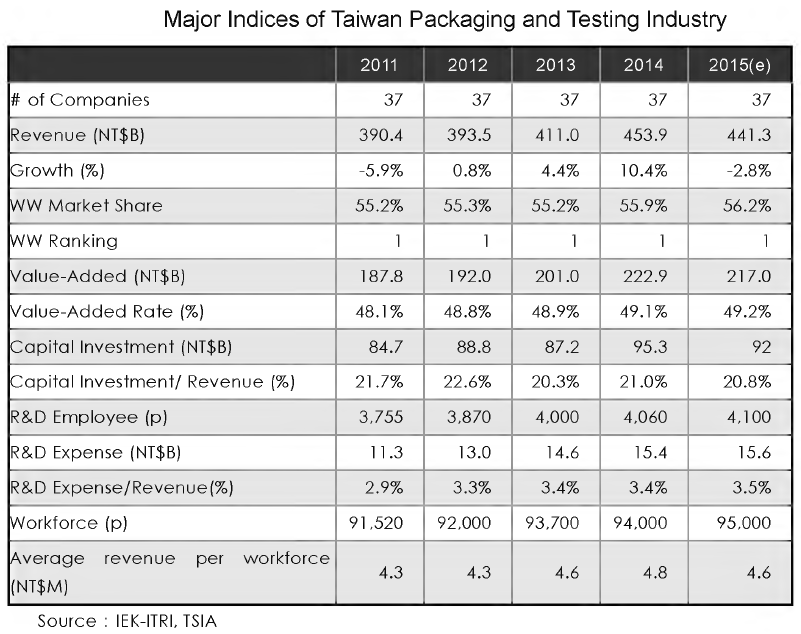

IC Packaging and Testing

Taiwan's IC packaging and testing revenue reached NT$453.9 billion (including domestic and overseas sales) in 2014, with NT$316 billion from packaging and NT$137.9 billion from testing. Taiwan's IC packaging and testing industry remained the number one worldwide, representing 55.9% of worldwide packaging and testing revenue, followed by the US and Singapore.

Total revenue of the top 5 companies comprised 69% of total Taiwan packaging and testing revenue and that of the top 10 comprised 81.1%. The major companies are ASE, SPIL , PTI , Chipmos, and Chipbond.